It just gets worst by the day for American iconic computer/cell phone company ….

New York-based law firm Bronstein, Gewirtz & Grossman has announced it is investigating whether Apple and certain executives violated U.S. federal securities laws after the company lowered its revenue guidance by up to $9 billion for the first quarter of its 2019 fiscal year earlier this week.

The law firm is conducting the investigation on behalf of AAPL shareholders, with potential for a class action lawsuit, and encourages affected investors to obtain additional information and assist the investigation by visiting its website.

Bernstein Liebhard LLP, another New York-based investor rights law firm, launched a nearly identical investigation of Apple earlier this week.

Apple CEO Tim Cook in a letter to shareholders this week disclosed that Apple’s revenue for the quarter just ended will be approximately $84 billion, significantly lower than its original guidance of $89 billion to $93 billion, due to “lower than anticipated iPhone revenue, primarily in Greater China.”

Both investigations contrast the positive language that Cook has previously used when speaking about China with the weaker language used in his letter to shareholders this week, in which he said Apple “did not foresee the magnitude of the economic deceleration, particularly in Greater China.”….

Oh, and this is also going on….

Yesterday chipmaker Qualcomm announced that it posted €1.34 billion in security bonds required for the chipmaker to enforce a preliminary injunction on select iPhone models in Germany, after a court in the country found Apple to be infringing Qualcomm patents related to power savings technology in smartphones.

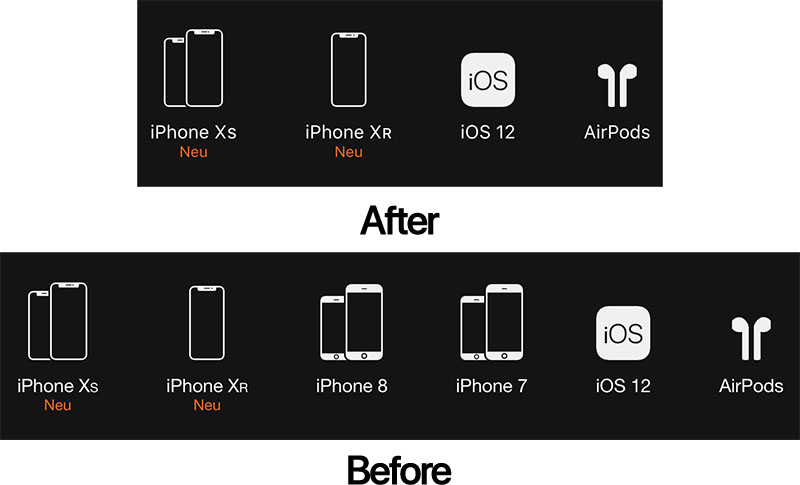

The injunction blocks the import and sale of infringing iPhone models in Germany while Apple appeals the verdict, and accordingly, Apple has now pulled the iPhone 7, iPhone 7 Plus, iPhone 8, and iPhone 8 Plus from sale in the country….